2 min read

The Reversal of Fortunes Benefits Start-Ups

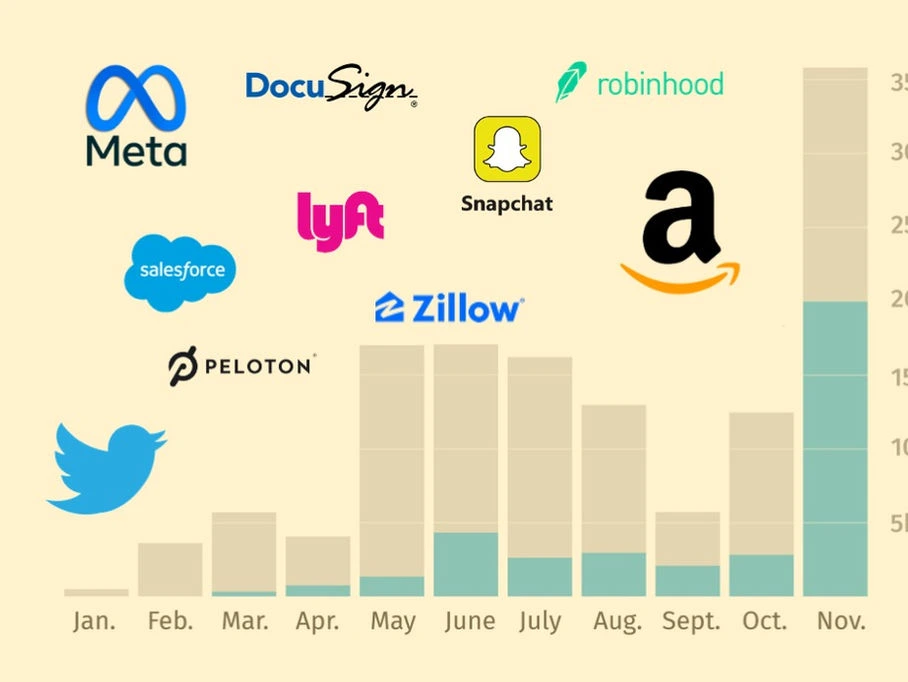

Almost 135,000 tech workers have been laid off from major tech companies in Silicon Valley and elsewhere. A little more than ago, our portfolio companies, like many other small start-ups, were struggling to get the talents they needed since the FANGs and aspiring FANGS were easily offering 2x salaries and cushy benefits, as well as the opportunity to work on some cutting-edge technologies.

We all know what has happened in the past six months — Google, Twitter, Meta, and Amazon are just the most notable examples (Amazon reportedly is even considering if the Alexa project, with 10,000 employees in it, should stay or not). Google employees are getting nervous about new performance requirements.

This is all excellent news for early-stage startups. To be sure, it is not a case of Schadenfreude. We all need to have the bellwethers of technology, especially such major ecosystems as Google, Apple, and Amazon, to be strong and to continue to innovate, as they have the deepest budgets and strong know-how. It is, however, a very fortuitous situation, and our recommendation for the start-up is to take advantage of this opportunity.

There is also a parallel pattern in the funding environment, though not as strong. Not only has the valuation of the late-stage companies come down a lot more (50% or more compared to about 20% or so for early-stage), but the appetite of investors is greatly diminished for the late-stage companies in general. Early-stage is a different story since they have three to seven years to prove themselves, and by that time, the current turmoil in the capital market has likely subsided, or we may even have another IPO boom.

All of this tells me that early-stage startups should not heed the call to cut back all costs but rather be prudent and try to take advantage of these trends to strengthen their position and talent pool.

Stay Connected

Receive our occasional thought pieces and insights.