3 min read

The Great Reversion- 2022

We have entered a new era in 2022. The massive decline in the capital markets, the high inflation, and the impending recession mark the start of this era, but the transition we are going through is likely to be multi-decade long.

On the economic front, we believe the rising interest rates are on track to increase the discount rate used in valuation of companies by at least 5% *. But more importantly, we believe the mindset of investors has changed from essentially ignoring valuation if the market opportunity is enormous to one that is nervously watching the cash position and is very valuation-sensitive. Startups need to adjust to this pivot by investors, even though it is partly a knee-jerk reaction.

The Great Reversion. We have entered an era we call the Great Reversion, not just in valuations but also in investment sectors, labor and regulatory environment, capital market orientations, and asset allocations. We believe the Great Reversion will have five distinct characteristics:

It is important to note that we are only forecasting a gradual and moderate shift in these directions, but a sufficient one to bring the over-swung pendulum closer to the middle, hence the Reversion. Of course, there will be continued investment in high-risk sectors, cutting-edge technologies, and new modes of communication and entertainment. But the momentum will be towards the sectors that are rebuilding the base of the economy.

Resilience. Faced with unprecedented volatility that has hit the world economy in the past two and half years (Covid, China, Ukraine, inflation, …), all countries will realize they must build resilience in their economy. Resilience requires solid infrastructure, redundancies, the ability of the industries to change production cadence and cycles, and even pivot. The efficiency of globalization all but eliminated resilience by creating intricate and strong dependencies on technology, natural resources and even labor. This trend will not be reversed but it has to be modified to offer more resilience.

In short, resilience will be a key the context of economic development and investment in the Great Reversion.

Where to Invest. During the past market declines, investors looked at the vibrant tech sector to pave the way to recovery, leading with cutting edge technologies in cloud computing, communication, commerce and entertainment, with companies such as Facebook, Netflix, Zoom, Amazon, Snowflakes, and Shopify. We believe it will be different this time, and the most promising sectors will comprise companies that are focused on improving the productivity of the traditional business, manufacturing and small businesses. Notably, the best companies in each area will have a robust tech backbone, but most investors may not categorize these companies as “Technology” companies.

To understand which sectors will prosper, we must bear in mind the defining characteristics of the current environment:

High costs of goods and labor

Unreliable and tight supply chain

High cost of capital

Volatile energy supplies and geopolitical risks

You will notice that these are precisely the opposite of the conditions that defined the past 20 years—the world economies grew with cheap capital while globalization reduced price and labor costs, allowing rapid product development with offshoring.

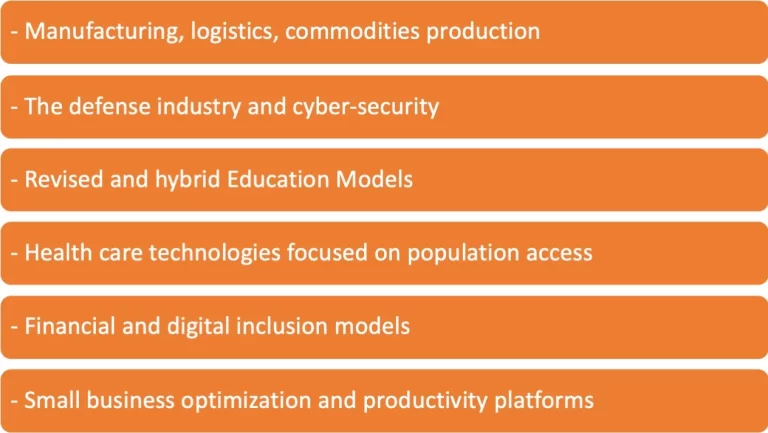

We believe building resilience in the era of Great Reversion will require investment in the following sectors (this is not an exhaustive list):

We will be exploring the above areas at Think + Ventures and we look forward to hearing from other investors and entrepreneurs on the sectors that they believe will be crucial for the Great Reversion.

*Discount rate used in calculation= risk free rate + asset volatility (beta)x equity risk premium. Risk free rate=3.5% (10 yr bond yields). Beta is volatility from mkt (higher than 1 beta means asset is more volatile than mkt (here we are taking 1.5 or 2 beta). Equity risk premium is the premium over the risk-free rate taken at 6%

Stay Connected

Receive our occasional thought pieces and insights.