2 min read

Investment Momentum Picks Up

As we near the end of the year, the quality of the deal flow we are seeing is improving. We are seeing continuing attrition of weak players and business models, which we believe will carry into 1Q21. We expect 2021 to present a major investment opportunity window for early-stage investors.

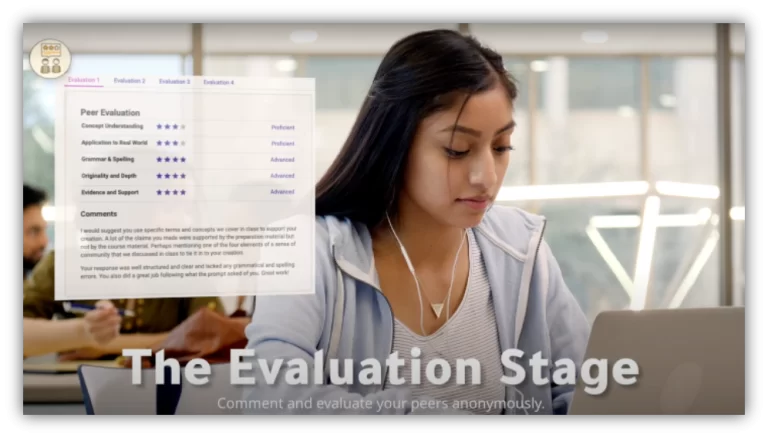

We have taken advantage of this environment and excited to announce that we have already made an investment for Think + Fund II (as we are working on the first close of Fund II): Kritik

Kritik aims to transform college students into critical thinkers through peer-to-peer assessments. Our investment thesis is simple: Assessment and content creation in higher ed is antiquated and doesn’t leverage students. This is a large, underserved, market of $4B initially, with the potential to expand to more than $20B. The founding team knows the complexity of the market and has already built a large business (Top Hat) in that market.

Kritik allows students to peer-evaluate each other’s work and generates quality and reusable content for future courses. The platform uses AI to normalize grades, identify the highest quality content, and assigns a critical thinking score to students. Kritik’s platform seamlessly integrates with many existing Learning Management Systems (LMS), making its adoption fast and easy.

We believe Kritik is well-positioned to be the dominant platform for collaborative education and assessment, ushering the next-gen of Ed Tech.

Trends we’re Watching:

Virtual fitness was already a trend before Covid, but because of the crisis, many businesses have had to pivot their services to deliver their offerings in a remote and socially-distant way. This has paved the way for a new era of digital fitness which has led to over 110% growth in Peloton. We are looking for new models to deliver a better and more personalized experience to consumers. New treatment methods will rise to address the mental health crisis that Covid-19 accelerated. Companies such as Flow that provide brain stimulation to treat mental illness or Mindstrong that announced $100 million funding helps predict how users are feeling, and Lyra which raised $110 million at $1B Valuation and provides better access to care, powered by technology. We are looking at digital therapy methods, as well as neuromodulation devices, that provide more efficacious treatments such as Innercosmos and Sana Health. There will be greater emphasis on social and demographic determinants of health and how they affect a person’s health status. The crisis has demonstrated how health disparities and risk-levels for a disease are impacted by income, geography, race and other factors. Mira, UniteUs, Healthify, NowPow, and others have seen an increase in demand from payers and providers. We continue to be hopeful that this elevated awareness will be durable post-COVID-19.Stay Connected

Receive our occasional thought pieces and insights.

Copyright © 2023 Think Plus+ Venture